The global manufacturing landscape continues to evolve rapidly, and industries dependent on industrial asynchronous motors and high‑efficiency motors are no exception. While demand for energy‑saving and robust motor technologies grows across industrial automation, infrastructure upgrades, and renewable energy sectors, production challenges tied to raw material availability and supply chain dynamics are creating ripple effects through the sector.

Understanding how supply constraints and cost pressures influence motor manufacturing helps buyers and engineers make informed decisions when planning purchases and scheduling maintenance.

1. Raw Material Volatility and Its Impact

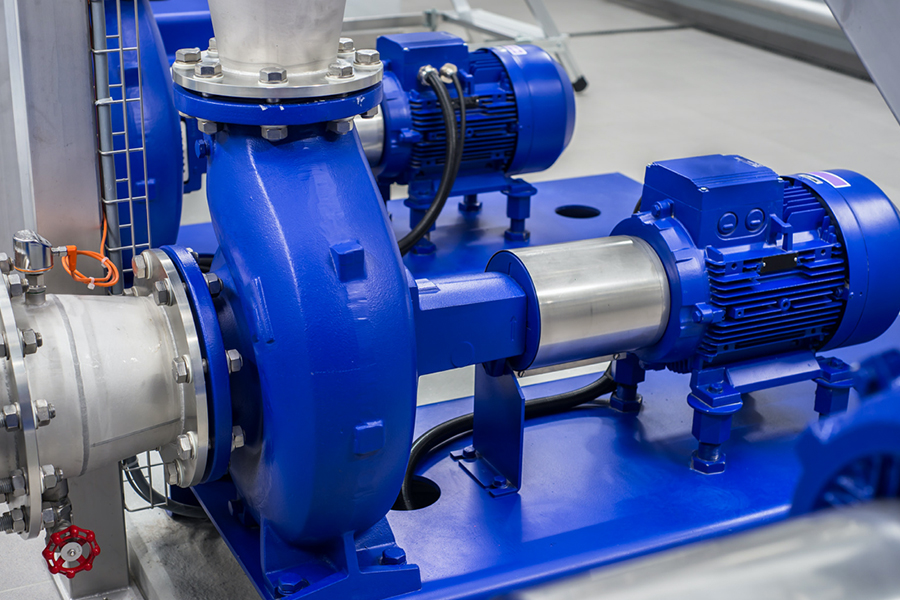

One of the more widespread issues confronting manufacturers is volatility in the cost and availability of essential raw materials such as copper, steel, and aluminum. These materials are core to the production of motor windings, cores, and frames. Recent market studies point to fluctuations in copper and steel prices as a significant factor raising production costs for asynchronous motor types.

Copper: As a key material for motor windings, copper’s price swings have a direct impact on production budgets. Increasing global demand from both renewable energy projects and electric vehicle manufacturing contributes to tighter supplies.

Steel and Aluminum: Used extensively in motor housings and rotor assemblies, these metals have faced price volatility due to geopolitical issues and shifts in global trade. Higher steel costs translate directly into higher manufacturing expenses for companies producing industrial asynchronous motors.

The result is a notable rise in production costs that can force manufacturers to either absorb the price increases — squeezing margins — or pass them along to customers, potentially slowing purchasing decisions.

2. Component Sourcing Delays and Lead Times

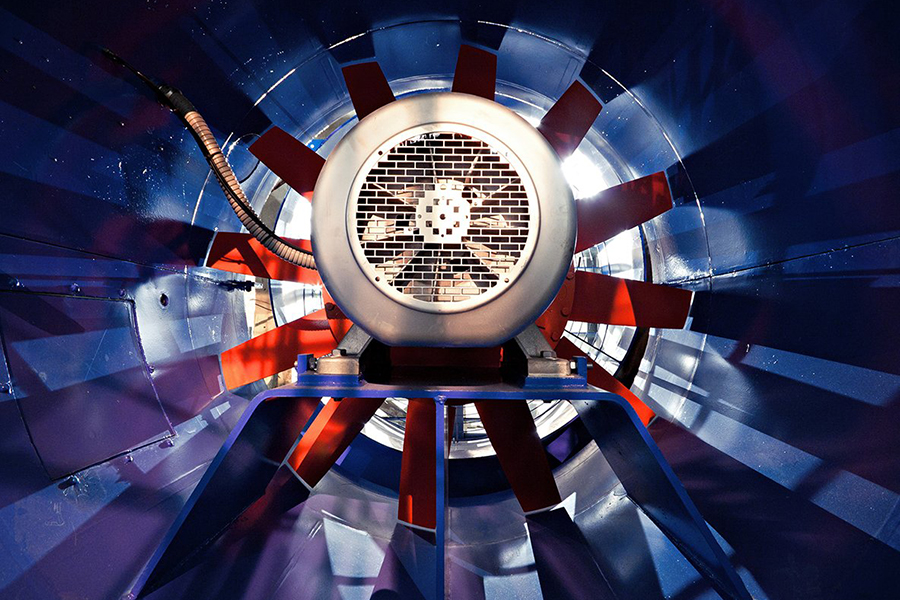

Beyond raw materials, modern motors increasingly require electronic components and control systems, particularly when integrating advanced features or pairing with variable frequency drives (VFDs). Global shortages in semiconductors and delays in parts delivery have extended delivery times across numerous industrial sectors, including motor production.

Chips and microelectronics: Used in motor controllers and sensor assemblies, these parts have seen allocation challenges as consumer electronics and automotive industries compete for the same supply.

Logistics bottlenecks: Delays in shipping, customs clearance issues, and port congestion affect the ability of motor manufacturers to keep production lines running at full capacity. Longer waiting periods downstream can frustrate end users relying on timely delivery for critical machinery.

These sourcing challenges have highlighted vulnerabilities in just‑in‑time manufacturing models and encouraged some companies to reassess inventory strategies.

3. Regulatory and Compliance Pressures

While energy efficiency regulations continue to push adoption of motors that meet stringent standards, these policy frameworks also add layers of complexity to manufacturing and supply chain compliance. Each region may implement different efficiency benchmarks and labeling requirements, imposing additional development and testing costs for manufacturers.

Efficiency standards: Regulations such as IE3 or higher efficiency classifications require motors to meet tighter performance and loss criteria.

Cross‑border compliance: Manufacturers aiming to sell globally must navigate a patchwork of performance standards and certification processes, which can delay market entry and add certification expenses.

Such regulatory landscapes can delay product rollouts and necessitate adjustments in supplier relationships and production planning.

4. Strategic Responses by Manufacturers

In response to these strains, many motor manufacturers are adopting strategies to improve resilience and mitigate disruption risks:

Diversifying suppliers: Reducing dependence on a single region or supplier for raw materials and components helps protect production schedules when localized events disrupt availability.

Inventory buffering: Some firms are increasing safety stocks of critical parts to avoid unexpected shortages during peak demand periods.

Localizing production: By shifting some fabrication closer to major end markets, companies can reduce transit times and minimize exposure to international freight volatility.

For industrial companies such as Zhejiang Ligong Motor Co., Ltd., these strategic shifts support more reliable fulfillment and help manage price stability for clients seeking consistent delivery of both standard and high‑efficiency motors.

5. The Broader Market Context

Despite these production challenges, the long‑term outlook for industrial motor markets remains positive. Demand for efficient, reliable motors continues to grow as industries modernize and adopt automation technologies. Reports indicate that asynchronous motors represent a significant portion of industrial installations worldwide, while high‑efficiency models are increasingly integrated into new system designs.

However, manufacturers and buyers alike are navigating a landscape where raw material costs and supply chain disruptions are key influencers in project planning. Understanding these trends ensures stakeholders can proactively manage timelines and budgets, whether implementing new installations or expanding motor fleets.

Turning Challenges into Planning Opportunities

Supply chain pressures affecting the production of industrial asynchronous motors and high‑efficiency motors underscore the importance of proactive planning and strategic sourcing. Volatility in raw material prices, delays in component supply, and evolving regulatory frameworks can complicate manufacturing and delivery, but they also offer opportunities for businesses to strengthen their operational resilience.

By embracing diversified supply strategies, investing in inventory optimization, and staying informed about global market shifts, motor buyers can better align production needs with supplier capabilities. As the industry continues to adapt, prioritizing flexibility and transparency in supply chain partnerships will benefit both manufacturers and motor end users in the long run.

English

English 中文简体

中文简体 عربى

عربى